LGIP Disclosure and Transparency: What Investors Are Missing

Last November we released results of our annual survey of local government investment pools, which...

How Trump’s $200 Billion Mortgage Purchase Order May Affect Public Funds Investors; LGIPs: New Pools and Manager Changes

I try to limit Beyond the News to single issues but this week we’re covering...

Recap of 2025: The Benefit, and Limits, of Hindsight

Hindsight is (usually) 20:20. With that in mind here’s a recap of how public funds...

New Bank Capital Requirements: A Credit Negative and More

When the Federal Reserve and other bank regulators approved changes to the capital requirements for...

Dashboard

Yield and portfolio information to help public funds investment officials manage portfolios, monitor markets and benchmark portfolio performance of local government investment pools (LGIPs) and short term portfolios.

Money Market Yields

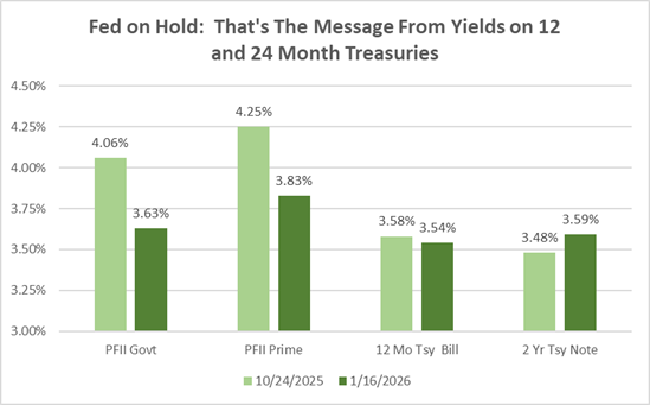

The Fed is on Hold: That's What Yields on One and Two-Year Treasuries Say

Futures contracts reflect a very low probability for the Federal Open Market Committee to cut the overnight rate further at its upcoming meeting next week. That view is also reflected in the yield on longer-duration Treasuries. They are in the 3.50% to 3.60% range. That’s just about the same level as the current overnight rate. A look back to October reinforces this view. The Fed has cut overnight rates by 50 basis points since mid October, and LGIP rates have declined apace, but one and two year Treasury yields have barely moved.

About Public Funds Investment Institute

We’re an independent nonprofit dedicated to informing, educating, and advocating for the $4 trillion investor community. Subscribe for research, weekly updates, best practices recommendations, and networking opportunities.

Insights

LGIP Disclosure and Transparency: What Investors Are Missing

How Trump’s $200 Billion Mortgage Purchase Order May Affect Public Funds Investors; LGIPs: New Pools and Manager Changes

Recap of 2025: The Benefit, and Limits, of Hindsight

Stay informed and ahead of market changes.

“Beyond the News” is our weekly publication, the “Dashboard” provides timely investment market data, and Research Notes provides in-depth analysis.

When you subscribe, you will receive email notices when we post news and research Insights. We respect your privacy – we will never sell or share your information, nor send you promotional or marketing emails.