Iran and Interest Rates

What impact will the Iran war have on short-term markets? The headlines have been all...

Calm or Complacent: Short Term Markets Are Uncertain

You might think that the recent news on the economy would lead to big market...

Banks vs. LGIPs: The Saga Continues

Banks don’t like local government investment pools. Except for those banks that provide investment management,...

Move to Expand Deposit Insurance Gains Momentum

A proposal to increase federal bank deposit insurance to $10 million on non-interest-bearing transaction accounts...

Dashboard

Yield and portfolio information to help public funds investment officials manage portfolios, monitor markets and benchmark portfolio performance of local government investment pools (LGIPs) and short term portfolios.

Money Market Yields

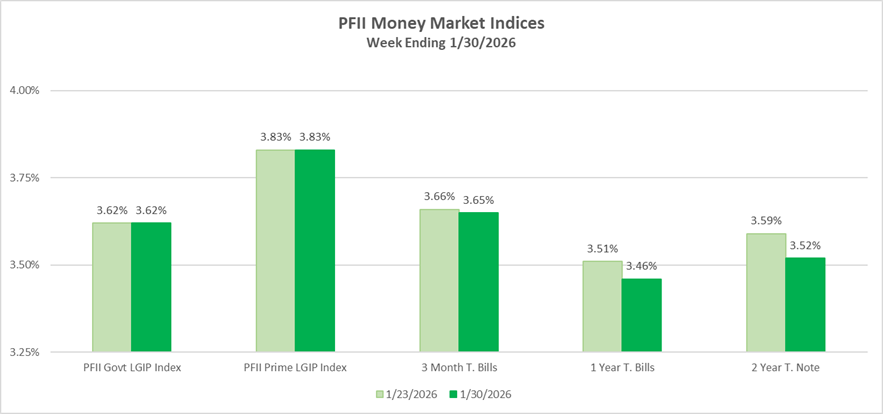

Big Week, Little Change

A flood of news last week had the potential to yield big moves in short-term markets. At the end of the week, though, the Federal Open Market Committee meeting, President Trump’s naming of Kevin Warsh as his nominee to chair the FOMC, the usual ups and downs in tariffs land and coming of another (short-term?) government shutdown had almost no effect on rates. LGIP yields were unchanged on the week Further out the curve one-and two-year Treasury yields declined modestly. Why is not clear. The FOMC statement at the end of the meeting, higher than expected producer inflation data and continued evidence that the economy remained on a growth path could mean future cuts were likely to be further out in time and more modest in size. But investors pushed 12-and 24-month rates lower by four and seven basis points respectively. Go figure.

A flood of news last week had the potential to yield big moves in short-term markets. At the end of the week, though, the Federal Open Market Committee meeting, President Trump’s naming of Kevin Warsh as his nominee to chair the FOMC, the usual ups and downs in tariffs land and coming of another (short-term?) government shutdown had almost no effect on rates. LGIP yields were unchanged on the week Further out the curve one-and two-year Treasury yields declined modestly. Why is not clear. The FOMC statement at the end of the meeting, higher than expected producer inflation data and continued evidence that the economy remained on a growth path could mean future cuts were likely to be further out in time and more modest in size. But investors pushed 12-and 24-month rates lower by four and seven basis points respectively. Go figure.

About Public Funds Investment Institute

We’re an independent nonprofit dedicated to informing, educating, and advocating for the $4 trillion investor community. Subscribe for research, weekly updates, best practices recommendations, and networking opportunities.

Insights

Iran and Interest Rates

Calm or Complacent: Short Term Markets Are Uncertain

Banks vs. LGIPs: The Saga Continues

Stay informed and ahead of market changes.

“Beyond the News” is our weekly publication, the “Dashboard” provides timely investment market data, and Research Notes provides in-depth analysis.

When you subscribe, you will receive email notices when we post news and research Insights. We respect your privacy – we will never sell or share your information, nor send you promotional or marketing emails.