Banks vs. LGIPs: The Saga Continues

Banks don’t like local government investment pools. Except for those banks that provide investment management, payment services, custody, or brokerage services to LGIPs. These include the nation’s largest banks (think JP Morgan, Bank of America, BNY, US Bank, State Street). But the rest, particularly the 4,000 or so community banks, are fierce competitors.

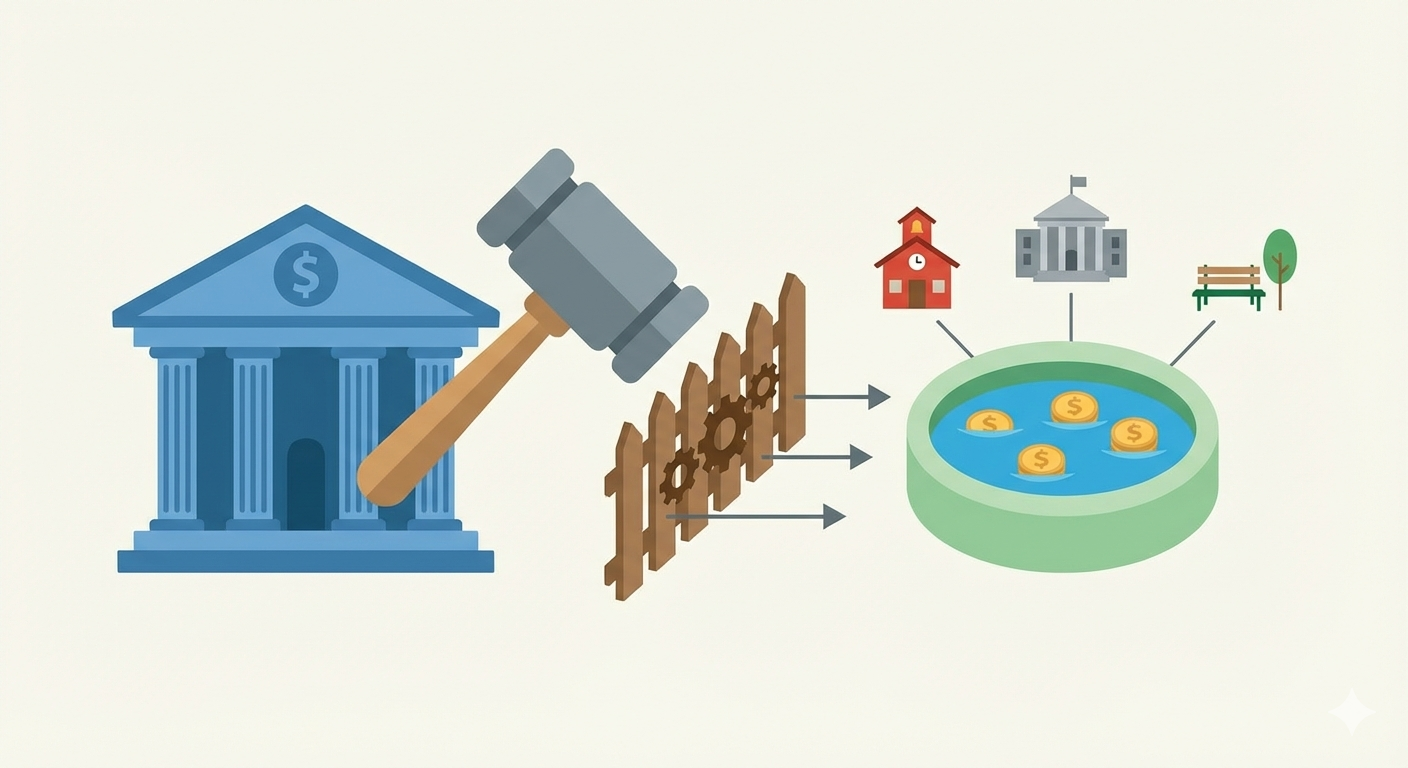

- Banks and LGIPs are in the same business. They gather money from “customers” and intermediate it into the financial markets. They “rent” the money (banks) or pass through the results of intermediating cash into short term investments (LGIPs).

- Banks aim to profit by this intermediation and they are subject to close supervision by government regulators while LGIPs pass through the results of their intermediation (“earnings” or “yield”) and are largely free of supervision (but “don’t commit fraud and stay within the investment guardrails that apply to your constituents”).

- In recent years the banks have brought this competition into the halls of state legislatures, asking them to limit the activities of the funds. A current legislative initiative in Iowa to rein in LGIPs is the most recent example of a years-long effort by the banking community.

- The Iowa effort is fueled by a research study by a free market organization that claims municipalities are giving up yield when they invest in one of Iowa’s two LGIPs instead of in Iowa bank deposits and that overall, the Iowa economy would benefit if LGIP activities were limited.

- The proposed legislation also would prohibit the payment of sponsorship fees to local government associations, opening another front in the long-standing tug of war.

Deep Dive

LGIPs are aggregators, collecting cash from municipalities, investing it in the global markets and—in some cases—offering payment services that normally require large balances and a lot of volume to be economical. Community banks are also aggregators, but their world is local, though they may loan money to or make reciprocal deposits in out-of-community banks, invest in Treasuries (just as LGIPs do) and participate in loans far from their localities.

The power of LGIPs is their ability as collective investment funds to buy investments like Treasuries, commercial paper or negotiable certificates of deposit that may be inaccessible to all but the largest municipalities. They pass through the income earned on these portfolios, less the expenses of operating the fund, just like money market funds. For smaller municipalities this is the only practical way they access the “wholesale” rates of the global money market. For large municipalities LGIPs may be convenient and eliminate the work required to manage individually every dollar of excess cash.

Banks have felt disadvantaged by LGIPs (and money market funds) since the pooled funds began in the 1970s. Initially the disadvantage was because of a cap on the rate that banks could pay for deposits (5.25%). And it is the requirement that banks hold capital to provide a cushion that they would have cash to pay depositors on demand or at maturity. LGIPs are not subject to capital requirements.

Deposit-raising at the local level has been squeezed by changes in the financial markets. The largest banks gained access to the wholesale markets, acquiring cash by issuing commercial paper, bonds and negotiable certificates of deposit and financing trillions of dollars of securities in the repurchase agreement market, but these channels were not open to smaller banks. Large banks grew by offering a variety of products and services beyond loans, and the funds became a ready channel for trading, large volume payment services, and custodial services. Again, smaller banks were left out.

Community banks appealed to the government, lobbying regulators for smaller capital requirements and lower deposit insurance assessments and arguing (unsuccessfully) that money market funds should be required to hold capital in addition to assets.

In the past several years bankers have taken aim directly at LGIPs. in New Hampshire, Nebraska, and Texas they mounted efforts to restrict the activities of public funds pools. The New Hampshire effort sought to restrict the state’s LGIP investments to deposits issued by in-state banks. in Nebraska the legislation was characterized as putting guardrails around the operation of the pools. In Texas proposed legislation would require that at least 35% of the investments by a local government be placed in Texas banks. None of these proposals became law.

Iowa is Asked to Limit LGIPs

The Iowa legislation, Senate Bill 2286 and House Study Bill 633, would limit deposits in an LGIP to 25% of the average of a “public subdivision’s public funds over the previous two fiscal years.” The bills also would prohibit LGIPs from paying any individual, association or organization that does not provide direct investment management, administrative or custodial services to the LGIP.

The debate in Iowa is informed by a study done by The Common Sense Institute, a research organization which describes itself as “a leading voice for free enterprise.” In a January 2026 report, Keeping Local Tax Dollars Local the CSI argued that moving municipal deposits from Iowa’s two LGIPs to local banks would boost the Iowa economy AND improve earnings on local government investments. And it would save money because local banks do not charge municipalities royalties or sponsorship fees.

But peel back the cover of this study and you’ll see problems. One is that it mischaracterizes the national LGIP industry. The CSI study concluded that 11 states have locally run LGIPS and 19 states have no public management of investments. The Public Funds Investment Institute’s 2025 annual survey identified 114 locally sponsored programs in 23 states and only seven states with no LGIPs. No state surveyed by PFII currently has limits on LGIPs like those proposed in Iowa.

For another, the CSI report asserts that banks are losing out to the LGIPs even though bank deposit rates are higher than pool yields. There is no hard data presented to demonstrate this, simply a reference to “bank deposit rates” information provided by the Iowa Bankers Association. Moreover, it’s hard to believe that government transparency and procurement practices have this result. (Imagine the city council or school board meeting where a local banker shows up and says they lost an investment opportunity when they offered 4% and the treasurer opted instead for something lower.)

Third, limiting investments in LGIPs would not necessarily direct them into local banks. Iowa local governments may invest in Treasuries, obligations of government sponsored enterprises and commercial paper. Some do this directly, but most do so through the LGIPs. Constraining this last option might lead more local governments to make direct investment in these securities, perhaps through the electronic platforms that—you guessed it—the mega-banks are rolling out for their customers.

Bottom Line

The Iowa legislation raises two issues worth considering. First, what priority should objectives other than safety, liquidity and yield have in investing public funds? And second, should tax dollars be used, directly or indirectly to make payments to government associations?

The first can be taken in many directions. Safety, liquidity, and yield are the watch words for public funds investors, but they are sometimes challenged by those who debate investing to promote (or more recently prohibit promoting) local economic development, affordable housing, ESG or DEI objectives, or support (or boycott) the state of Israel. Treasurers and portfolio managers usually respond to such entreaties (or demands) by holding up the shield of fiduciary responsibility. That’s all well and good though the shield doesn’t defeat those who argue that a particular investment strategy is “good public policy.”

The proposed legislation would outlaw sponsorship fees. They are not unique to Iowa or limited to association support for LGIPs. It is common for state and national associations to sponsor private sector programs, often offering investment advice, insurance, specialized consulting services and even human resources and legal services.

There are questions to be addressed here. Among them: Do associations have a role to play in the organization and delivery of such services? Should they have a role in overseeing, endorsing (“seal of approval”)? Should taxpayer dollars be used to support associations through dues, purchase of services, etc.? Supporters of a role for associations argue they are essential to knowledge-sharing, promoting good practices and supporting their communities. These efforts come at a cost. Do the taxpayers benefit from these services? If so, how should they be paid for?