Cash and Short-Term Portfolios Had Strong Returns in the First Half of the Year

The PFII Investment Dashboard has been updated through quarter-end and reflects a couple of interesting market dynamics.

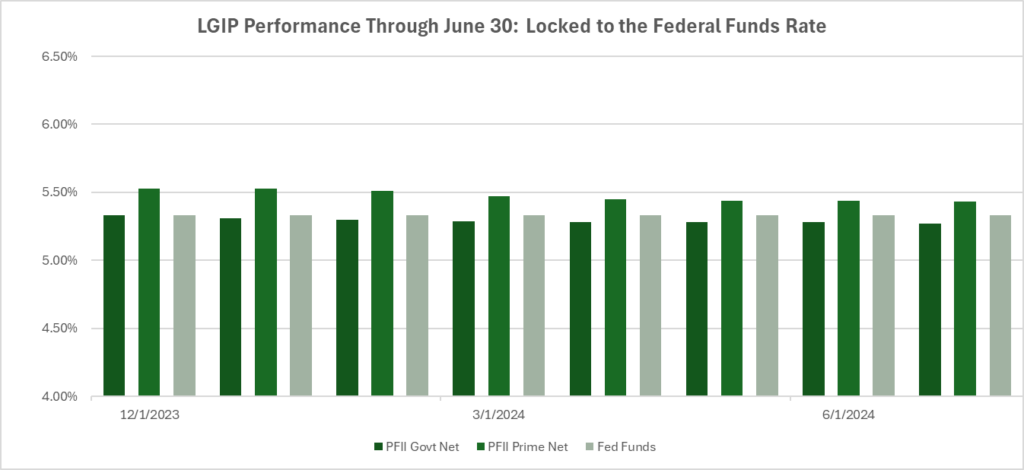

- Waiting for the Fed. LGIP yields have been locked around the Federal Funds rate. They are within a few basis points of their levels at the start of the year and likely will not move until the Fed changes its federal funds target. The challenge that LGIP managers face is that the money market yield curve has provided little advantage to extending maturities. Yes, three- and six-month investment rates are nominally higher than overnight rates, but the advantage is mostly offset by the loss of the compounding value of investments like overnight repurchase agreements. An overnight investment at a rate of 5.30% compounds over a year to 5.44%. So a one-year rate would have to offer a 14 basis point advantage to break even. That is likely the reason managers have kept weighted average maturities in the low to mid 30-day range even if they believe the Fed will reduce rates later this year.

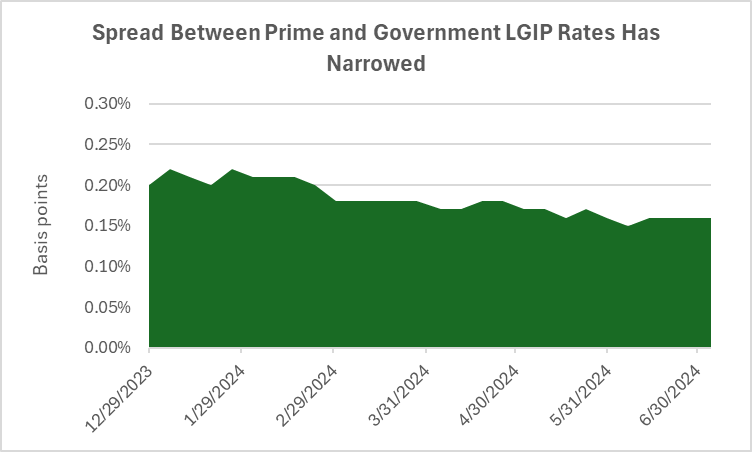

- Prime LGIPs are a bit less attractive. The spread between the PFII Prime LGIP Index and the government index has narrowed from 22 basis points in January to 16 basis points last week. Investing in commercial paper and negotiable CDs offers a smaller advantage than it did for much of 2023. Investors have once again discounted concerns about creditworthiness and liquidity and the risk premium for these instruments has shrunk.

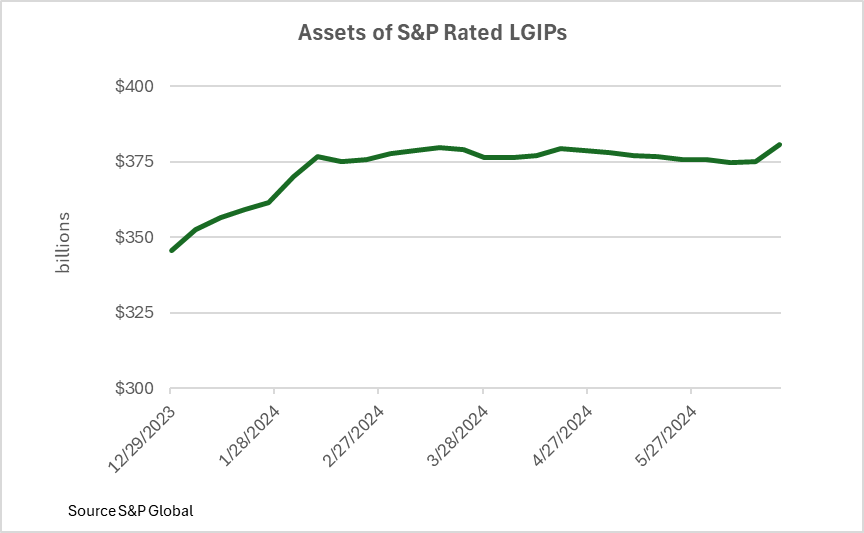

- LGIP assets are up by about 10%. S&P reports that the stable value LGIPs it rates added about $35 billion in assets this year. As we noted in a recent Beyond the News piece, public unit investment assets are growing very slowly and managers seem to be favoring liquid investments like LGIPs with the objective of building liquidity in the face of financial uncertainty.

- Money fund statistics reflect similar trends. They document solid asset growth and narrowing yield spreads between government and prime money funds. Money fund weighted average maturities show little movement since January.

- Separate portfolios have lagged cash, but returns have been solid. The PFII 1–3-year model portfolio returned 1.47% for the first six months of the year (that is an annual rate of 2.97%) and 4.93% for the prior 12 months. This lags returns on cash/LGIPs of 5.25% to 5.45%, but portfolios with maturities of two to four years—the PFII model has a duration of 1.64—will maintain their income for a longer period if/when the Fed cuts rates.

The 1-3-year model portfolio yield to maturity of 4.95% at the end of the quarter reflects this. The model portfolio also benefitted from holding corporate obligations. Thirty percent of the portfolio is invested in investment grade credit which out-returned the Treasury component by 27 basis points in the six-month period.