Early Alert: Government Shutdown May be the Next Challenge

Could a government shutdown complicate things for public funds investors?

Will Banks Compete for Your Deposits?

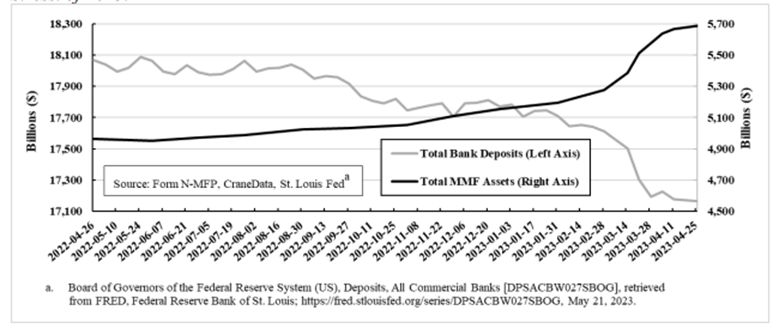

Have bankers called you recently? Bank deposits have trended down recently, and money fund assets have risen. Now banks are gearing up to build them back up.

Beyond the News Issue #4

This week: The SEC adopted new rules to strengthen the resilience of money market funds, but they may also further hamper the operation of institutional prime funds. Local government investment pools are not subject to these rules. but in a Spotlight piece to be released next week we’ll analyze some of the important implications for LGIPs. We also note an update from Fitch Ratings on its negative outlook for the AAA rating for the United States.

See you next week!

Beyond the News: Issue #3

Read the latest on the end of LIBOR, the introduction of SOFR, and the implications for public funds portfolios. Stay informed about money market reform and potential bank consolidation in the industry.

Beyond the News: Issue #2

We start this week with a comment on the Federal Reserve’s annual bank stress test results, released June 28th—not because they held any real surprises but because they clear the deck for the next act during which the banks, the regulators, and perhaps Congress, will arm wrestle over changes to capital requirements and bank supervision. This could lead to a major alteration in the bank landscape for depositors and investors. There is also the July 1 rollout of FedNow, the new 24/7 payment system. And finally, a bow to money market yields, now largely north of 5%.

Beyond the News: Issue #1

Beyond the News this week covers bank regulations, the status of the SEC’s Money Market Reform proposal and a quick comment on Crypto.