Is Monetary Policy Broken?

This may appear to be a bit wonky for some public funds investors who have...

Cracks Are Appearing in the Credit Markets

Cracks are appearing in the credit markets and public funds investors should amp up risk...

2024 LGIP Survey: LGIPs Hold Nearly $1 Trillion of Public Funds

Our annual survey of local government investment pools is out. This year we expanded our...

Bank CDs: Available for Investment, But is There Value?

States and localities have long invested in bank certificates of deposit because they are familiar,...

Dashboard

Yield and portfolio information to help public funds investment officials manage portfolios, monitor markets and benchmark portfolio performance of local government investment pools (LGIPs) and short term portfolios.

Money Market Yields

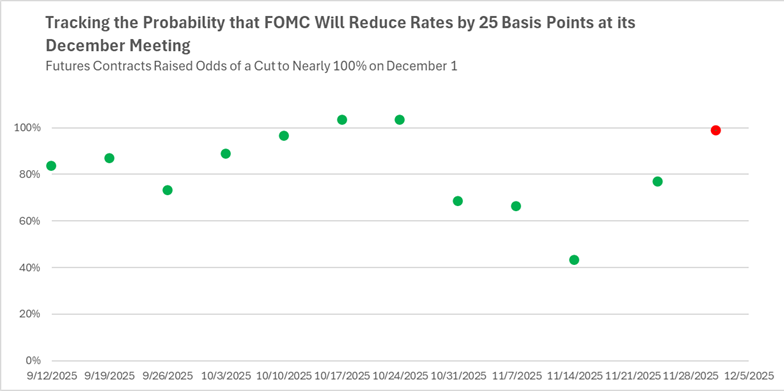

Tracking the Fed: Markets Have Raised the Odds of a Rate Cut

Market sentiment has now moved strongly to expect a cut of 25 basis points at next week’s Federal Open Market Committee meeting. This is a big reversal in a short period. It doesn’t appear that much has changed in the economy in the past couple of weeks, though the delay/absence of good data stemming from the government shutdown certainly does not lend confidence to the outlook. Rather investors have read the most recent speeches and statements by a majority of FOMC members as supporting a step to ease rates.

About Public Funds Investment Institute

We’re an independent nonprofit dedicated to informing, educating, and advocating for the $4 trillion investor community. Subscribe for research, weekly updates, best practices recommendations, and networking opportunities.

Insights

Is Monetary Policy Broken?

Cracks Are Appearing in the Credit Markets

2024 LGIP Survey: LGIPs Hold Nearly $1 Trillion of Public Funds

Stay informed and ahead of market changes.

“Beyond the News” is our weekly publication, the “Dashboard” provides timely investment market data, and Research Notes provides in-depth analysis.

When you subscribe, you will receive email notices when we post news and research Insights. We respect your privacy – we will never sell or share your information, nor send you promotional or marketing emails.