What to Expect in a Government Shutdown

I have no idea what the outcome of the government shutdown will be. There is no predicting, and any forecasts are laden with political overtones. But it sems useful to look back at the effects of the last prolonged shutdown, December 2018-January 2019, to see how the economy and financial markets responded. That shutdown lasted 35 days. The prior one was in 2013 (it was 16 days) and, before that, one must go back to the 1970s and 80s.

I have no idea what the outcome of the government shutdown will be. There is no predicting, and any forecasts are laden with political overtones. But it sems useful to look back at the effects of the last prolonged shutdown, December 2018-January 2019, to see how the economy and financial markets responded. That shutdown lasted 35 days. The prior one was in 2013 (it was 16 days) and, before that, one must go back to the 1970s and 80s.

Here’s what to note:

- The 2018 shutdown pushed interest rates lower, widened credit spreads and increased market volatility but did not influence the underlying direction of the economy or the markets.

- This time could be different if the shutdown is accompanied by firing of several hundred federal workers as the Trump Administration has threatened. (In 2018 employees were furloughed or temporarily deprived of pay.) This could inflict lasting damage to the economy, but it will take several quarters until the effects are realized and measured.

The economy

Broad measures of economic activity like gross domestic product are unlikely to reflect the immediate effects of a shutdown. GDP and related productivity and inflation measures are computed quarterly so effects will be delayed and buffered by time.

Moreover, as noted, the 2018 shutdown involved furloughing government workers or delaying their pay, so any impacts were transient.

Nevertheless some high frequency economic measures did respond.

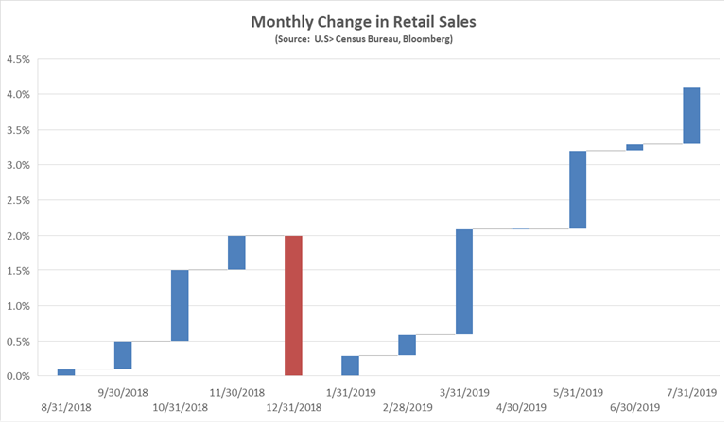

Retail sales, measured monthly, plummeted at the end of the year and it took until the spring for sales to recover.

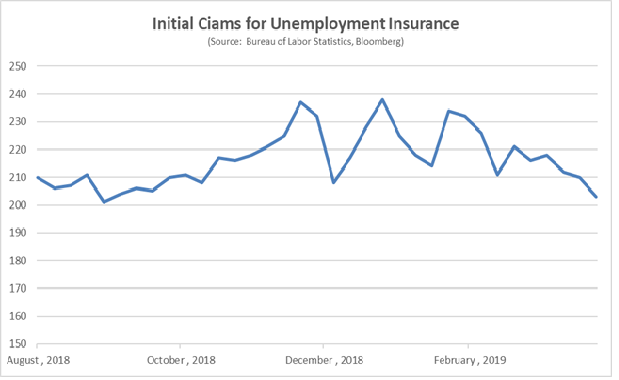

Weekly claims for unemployment insurance were not affected by the shutdown, nor were the statistics in the monthly employment reports. The below chart shows only the usual month to month variations in claims.

Financial markets

Markets reacted to the 2018 shutdown negatively.

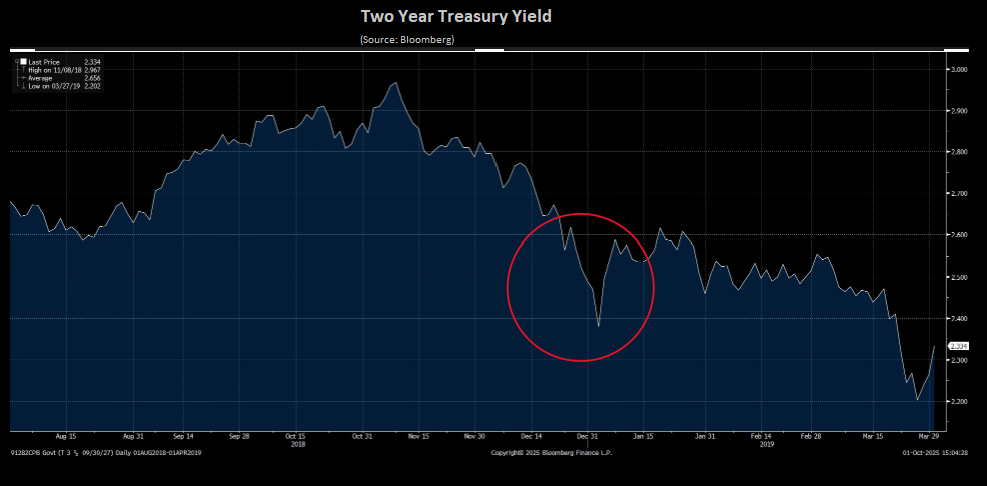

- Two-year Treasury yields declined about 20 basis points from about 2.60% before the shutdown. Treasury yields declined by comparable measures across the curve: 10-year Treasuries declined in yield from about 2.80% to 2.55% before recovering when the government reopened. Interestingly Bloomberg has reported that by the end of last week investors in the options markets have staked out big positions betting on a similar move in the 10-year Treasury this time around.

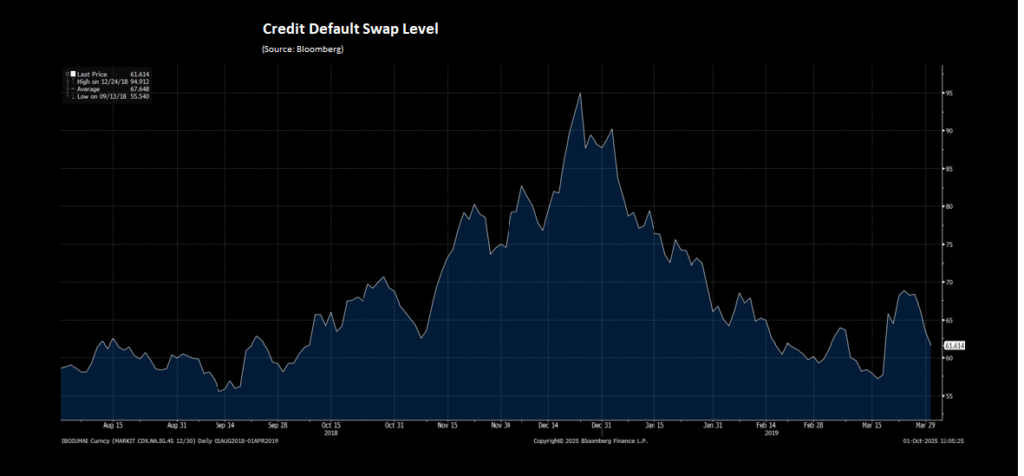

- Credit spreads widened, with a broad measure, the level of five-year credit default swaps, moving from 75 basis points to around 95 basis points . Investors demanded a greater rate premium for taking/holding credit.

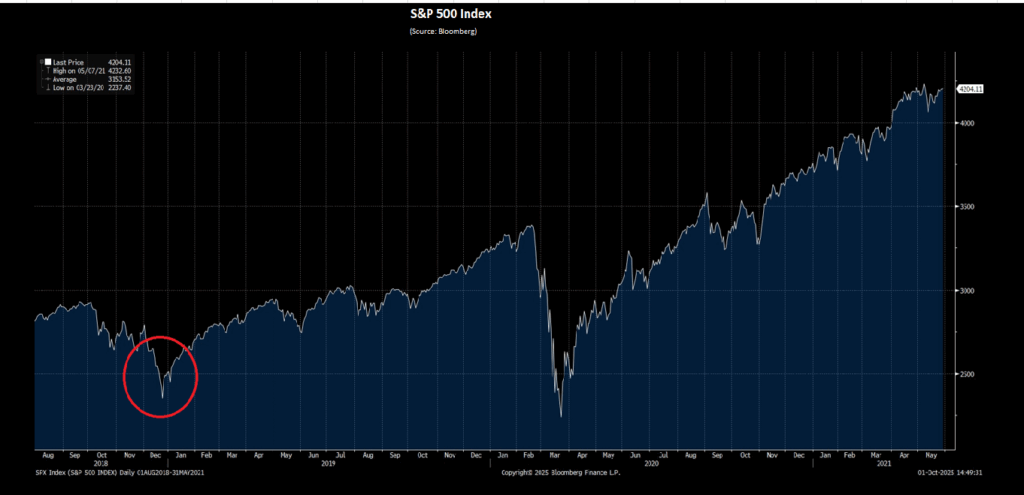

- No surprise that stocks declined in this period. The S&P lost about 15% in December 2018 which it recovered when the shutdown ended.

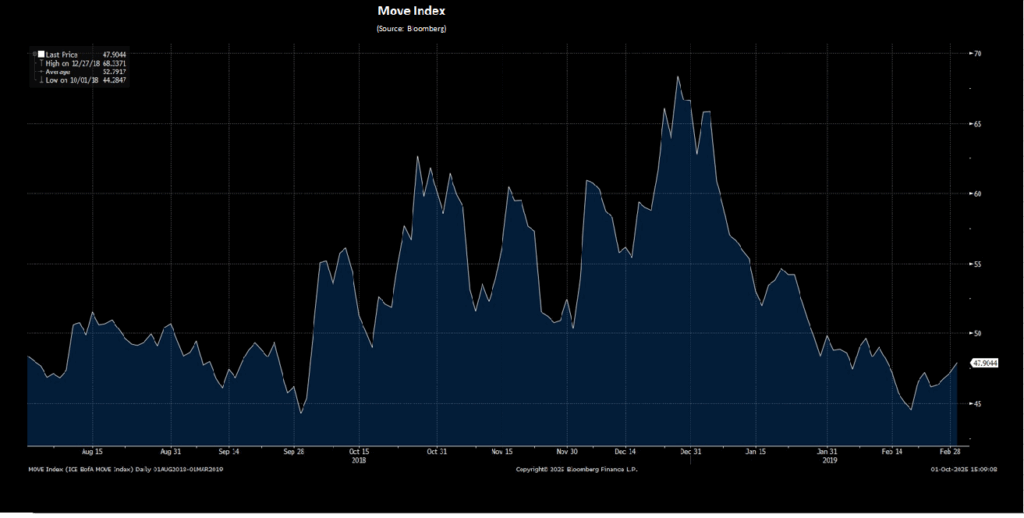

- Market volatility ticked higher with the MOVE Index of bond option volatility (see below) rising from about 50 to nearly 70 in December 2018, before recovering in January, 2019.

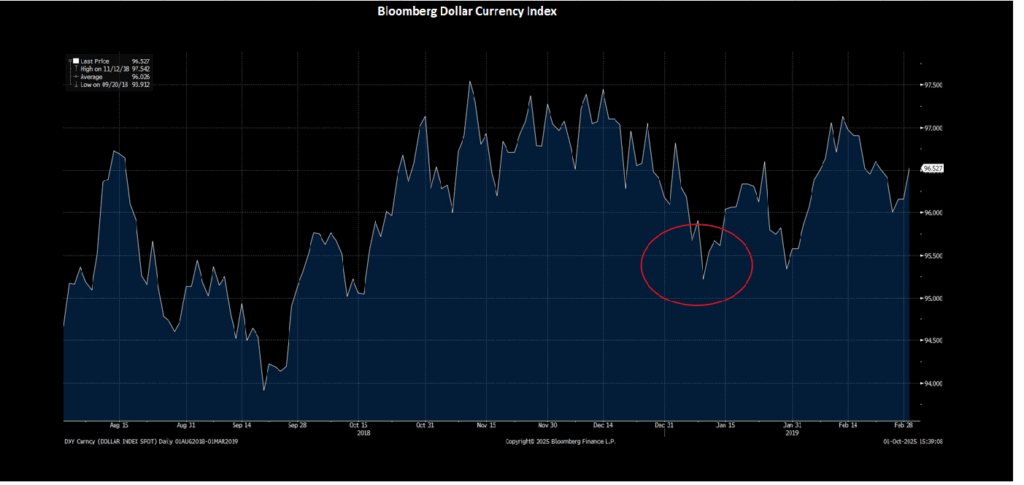

- The U.S. dollar lost about two percent of its value compared with a basket of other currencies. It too recovered when the shutdown ended.

All of these were modest moves.

Meanwhile

- Money market rates, reflected in yields for local government investment pools, money market funds and the yield on short-term Treasury bills, were unaffected. The yield of the three-month Treasury bill moved in a range of less than 10 basis points in this period.

- The Federal Reserve met in the week before and again two weeks after the 2018 shutdown. The Federal Open Market Committee statements after those meetings did not comment on the shutdown.

Bottom Line

It wasn’t that the market had no reaction; it’s that the reaction was measured, especially when compared with responses to other government dysfunction such as the notorious tendency to threaten to default on debt by creating debt ceiling crises.

This shutdown could be different because the Trump Administration has threatened to fire hundreds of thousands of federal workers. In prior standoffs they were either furloughed or had their pay deferred. Doubling or tripling the weekly claims for unemployment insurance would be sure to depress employment and boost the unemployment rate. Some economists forecast it could rise by 0.2-0.4%. And a weak jobs market could add to pressure on the Federal Reserve to cut short term rates, even if inflation is above its two percent target.

If the lost government jobs are reversed through mass re-hiring when the shutdown ends the longer-term effect on economic activity is likely to be modest. If not, most mainstream economists believe the shutdown will slow economic activity for the next several quarters. Then there is the view of the Trump administration that much of the shuttered activity would eliminate a drag that has has hampered growth.

Time will tell.