Why [Some] Investors Seem to Ignore The likelihood of Lower Rates Ahead

The path ahead for interest rates seems clear: the Federal Reserve will soon begin to reduce its policy rate, bringing down short-term rates generally. This has been the outlook for a couple of months, with only the timing and magnitude of cuts in question.

- In theory—Investments 101 if you will—this should lead investment pool managers to extend weighted average maturities and investors to shift funds from floating rate securities (LGIPs and money funds) to those with fixed rates (Treasuries and bank CDs).

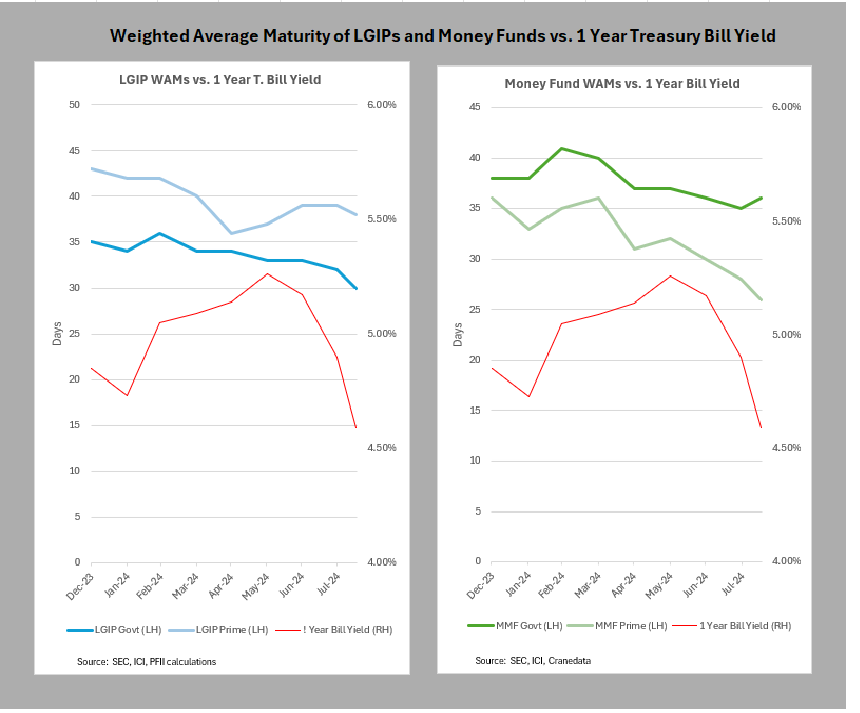

- Yet LGIP and money fund maturities remain short. The accompanying charts show weighted average maturity (WAM) trends and the yield on the one-year Treasury bill which has fallen by more than 50 basis points since early spring. The latest data on S&P rated pools from mid-August shows average WAM of 30 days for government-oriented pools and 38 days for prime LGIPs. Rating agency guidance for AAA rated pools and Securities and Exchange Commission rules for money funds limit WAMs to 60 days, so current positioning is indeed short. Since June, WAMs of government-oriented LGIPs have declined by three days; those of prime LGIPs are essentially unchanged. Money fund managers also have shortened WAMs for government funds to 36 days in mid-August from a 2024 peak of 41 days early this year and prime funds from 36 to 26 days in this period.

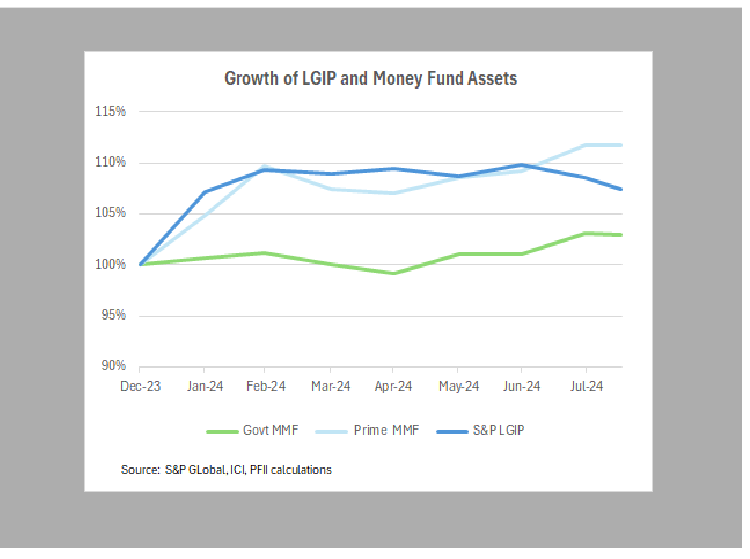

- Assets of S&P rated LGIPs are at or near all-time highs, and do not show signs that investors have undertaken a big move out of variable rate pools to lock in fixed rates. (The downward move in recent weeks is consistent with historic seasonal moves.)

Meanwhile money market fund assets grew steadily this year and are at all-time high levels.

It’s not that pool managers and investors are ignorant of the lessons of Investment 101. Rather it seems to be a response to the signals and motives in the world of stable value pools.

Cash pools are all about stable value (which investors largely take for granted) and backward-looking yield. Of course, yield is not called “backward-looking” but that’s just what it is.

Most LGIPs publish seven-day net yields; those that do not, publish a figure that investors equate to seven-day yields for purposes of comparing/selecting pool investments. Money funds publish seven-day yields as well. These published yields look back at past performance.

Based on the “manage to what is measured” theory, pool investment managers may prioritize a high seven-day yield, sacrificing the opportunity in the current market to lock in longer-maturity investments that would give up a few basis points in current yield to capture rates for a longer term. With all eyes on seven-day yield, will anyone notice?

When rates are on the rise, this focus on current yield will lead to shortening a pool’s WAM to be able to rollover the portfolio more quickly. In a stable rate environment focusing on seven-day yield is not likely to have consequences for strategy.

But with the Fed about to cut rates, the highest-yielding money market securities are those with short maturities (or floating rates). So, a portfolio manager who wants to maintain a high current yield will concentrate pool investments in short maturities. This strategy may produce a lower level of income over time (three months, six months) compared to a strategy that extends WAM now, but it will preserve the pool’s high yield for now. And the truth is that there is little transparency or investor focus on how pools perform over time.

Focusing on seven-day yield can lead to this (silly) result: assume a pool has a WAM of one day and the Fed cuts rates by 25 basis points today. Tomorrow’s published yield would not reflect the cut (it would average the prior seven days), even though if you invested tomorrow, you would likely earn 25 basis points less than the then advertised rate beginning on the day you invested. Only after seven days would the advertised yield fully reflect the lower (post-cut) income of the pool. To be clear, there is no trick or intention to mislead here. For LGIPs the yield calculation is mostly a convention that relies on the Securities and Exchange Commission’s guidance for money funds.

Publishing supplemental portfolio characteristics statistics could provide signals about the expected path for a pool’s yield. Money funds are required to publish supplemental information and some LGIPs follow this standard, but many do not. Publishing WAM, liquidity, net asset flows and daily shadow net asset values helps investors assess the speed of changes in seven-day yields. For example, a pool with a WAM of 20 days and recent asset inflows is likely to see current yields change more rapidly than one with a WAM of 50 days and declining asset levels. In an upcoming piece we’ll dig into this and provide some guidance on the velocity and magnitude of yield changes when the Fed changes its policy rate.

Reliance on investment portals to facilitate investments encourages a focus on current yield. Portals—intermediaries that direct investor funds into specific money funds—account for a fair share of money fund activities. This amplifies the focus on where a pool stands TODAY in the lead tables, if you will, as it is doubtful that a portal would seek to use their “forecast” of future yields rather than looking at the advertised seven-day yield. There would be no upside and a lot of downsides to such an approach. In this way portals reinforce the current yield herd mentality.

Portals do not (yet) account for a significant amount of LGIP assets, but they are a powerful intermediary in the money funds industry.

Pool assets are sticky because moving money from a pool to a fixed rate investment is not easy. There are a few LGIPs that offer fixed rates portfolios and easy transferability, but finding an alternative for cash takes time and effort. That’s a major reason pool assets are sticky. Even buying a Treasury is a big deal! Who do you call? Do you have to bid the purchase? Where will the security be held? Etc., Etc. Buying a CD involves similar complications: How do you find the market rate? Do you have to bid it? How many phone calls/emails will that take? If you call your friendly banker, will they offer to go to lunch or play golf, when alI that you want is a rate that you can lock in? These are practical hurdles—inertia if you will—that make pool assets sticky.

Investing cash competes for time/attention with running the buses on time and maintaining facilities leases. Treasurers/business managers have many tasks and investing cash may not be as important as some others. Case in point: among their many duties, a school district business manager may be responsible for managing the school buses as well as investing cash. It’s not hard to guess which of these will get the attention of (angry) parents and the school board. In the corporate world, things are not that different. With the treasurer responsible for cash and payments, banking and debt issuance, their boss—the CFO or the board of directors—will not be as sensitive to investment income as to the financial ratios that are on the financial statements.

The bottom line. Investment 101 principles apply well for separately managed working capital portfolios where extending maturities can yield incremental income over time, the investment performance horizon is a quarter year, a full year or longer, and where the current yield is not the basis for moving money day to day.

In the pool world that’s not the case and investors should keep this perspective in mind when evaluating pools based on yield. In short, what you see may not be what you get.

The LGIP industry could help the effort by disclosing portfolio characteristic information as the money fund industry does, to inform investors about what’s ahead. A few LGIPs do so, but for those that do not, adopting the SEC’s disclosure and transparency standards should be the order of the day.