Is It Time to Go Long?

With all the talk of higher interest rates, unexpected strength in the US economy and an unsettled political situation here and globally, is now the time to go long? For the past two years cash-like investments (especially stable value LGIPs) have been the winners as rising interest rates produced losses in bond portfolios, but at some point the tide will change. For public funds investors, where “long” means two- or three-year maturities now may be that time.

Are LGIPs a Safe Harbor from Bond Market Volatility?

With financial news headlines screaming Treasury market volatility and commentators warning that the sharp rise in interest rates could cause dangerous market dislocations, one might wonder about the stability of money funds and LGIPs.

Recent Moves by LGIP and Money Fund Managers Support View that Fed is Nearly Done Tightening

Money market fund and local government investment pool managers have been re- positioning portfolios on the assumption that the Federal Reserve is near the end of its tightening cycle. The moves have taken place incrementally over the past several months as the “nearly done” mantra suffused the market.

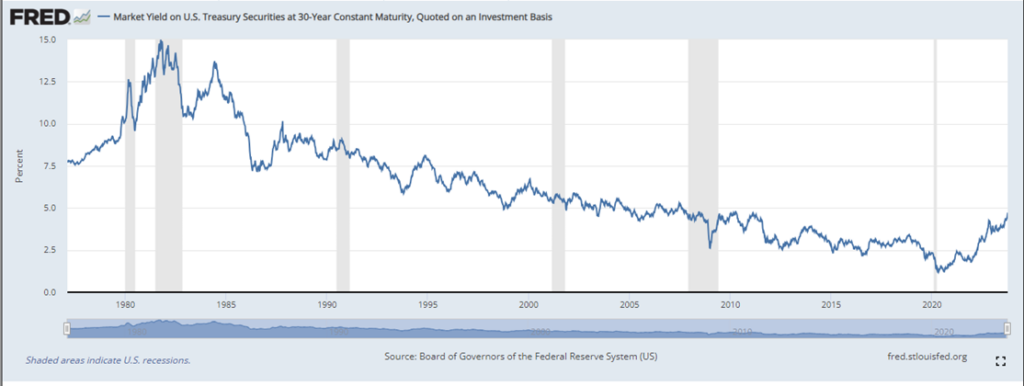

The Surge in Bond Yields—Big Deal or Not?

The recent surge in long term yields may signal a big change in the outlook for the US and global economies.

Countdown to Shutdown

A Federal government shutdown heightens uncertainty; Moody’s climbs on board, and more in this week’s Beyond the News.

LGIP Investment Strategies Presume A Pace of Slow Monetary Policy Tightening

Local government investment pools extended maturities in recent weeks, anticipating the shift in Federal Reserve monetary policy that reduced the pace of tightening after the sharp run-up in interest rates over the past 18 months. Pool portfolios moved from very short weighted average maturities (WAMs) in the spring and are now positioned for limited moves higher in interest rates in the near term. Meanwhile pool yields have risen to fully reflect current market conditions.

Federal Home Loan Banks Under Review

A Federal review of the Federal Home Loan Banks is coming up; also new bank capital rules; and a government shutdown?

LGIP Trends: Higher Yields, Plateauing Assets, a Bit More Risk

Moderating asset growth, higher yields, and a move to a somewhat less defensive market risk position sum up local government investment pool fundamentals in the second quarter.

Seems Like Banks Just Can’t Stay Out of the Headlines

Last week Moody’s took ratings action on 27 US banks. This week (so far) the chairman of the Federal Deposit Insurance Corporation announced that his agency would issue regulations requiring that large regional banks (assets greater than $100 billion) adopt “living wills” to facilitate resolution in the event they become insolvent. And FitchRatings warned that it could downgrade dozens of US banks.

Fitch Ratings Downgrades US Sovereign Rating; Immediate Impact on Public Funds Investments is Limited

Fitch Ratings Downgrade of US Debt should have limited immediate impact on pubic funds investments